In the world of personal finance, two philosophies have emerged as polar opposites: Financial Independence, Retire Early (FIRE) and You Only Live Once (YOLO). These contrasting approaches to money management have gained significant traction in recent years, sparking heated debates among financial enthusiasts. In this blog post, we’ll dive deep into the core principles of FIRE and YOLO, explore their pros and cons, and help you determine which path aligns best with your financial goals and lifestyle preferences.

Understanding the FIRE Movement

FIRE, an acronym for Financial Independence, Retire Early, is a financial strategy that emphasizes aggressive saving and investing to achieve financial freedom at a young age. Proponents of FIRE aim to accumulate enough wealth to cover their living expenses through passive income streams, allowing them to retire decades before the traditional retirement age.

The FIRE movement gained prominence in the 1990s with the publication of Vicki Robin and Joe Dominguez’s book, “Your Money or Your Life.” The book challenged conventional notions of work and consumption, encouraging readers to reassess their relationship with money and prioritize financial independence.

Key Principles of FIRE

- High Savings Rate: FIRE adherents strive to save a significant portion of their income, often 50% or more, by living below their means and minimizing expenses.

- Investment Strategy: FIRE practitioners typically invest in low-cost index funds and real estate to generate passive income streams that can sustain their lifestyle.

- Frugality: Embracing a frugal lifestyle is a cornerstone of the FIRE movement, as it allows individuals to maximize their savings and reach financial independence faster.

- Long-Term Planning: FIRE requires a disciplined, long-term approach to financial planning, with a focus on creating a sustainable retirement income stream.

Pros of FIRE

- Financial Freedom: FIRE offers the potential for early retirement and the freedom to pursue passions and interests without the constraints of a traditional 9-to-5 job.

- Increased Control: By achieving financial independence, FIRE practitioners gain greater control over their time and life choices.

- Reduced Stress: Financial stability and the absence of work-related pressures can lead to reduced stress levels and improved overall well-being.

Cons of FIRE

- Delayed Gratification: The FIRE lifestyle often requires significant sacrifices in the short-term, such as foregoing luxury purchases and experiences, in pursuit of long-term financial goals.

- Market Volatility: FIRE relies heavily on investment returns, making it vulnerable to market fluctuations and economic downturns.

- Potential for Burnout: The intense focus on saving and frugality can lead to burnout and a sense of deprivation, especially if the journey to financial independence is prolonged.

Embracing the YOLO Mindset

In stark contrast to FIRE, YOLO (You Only Live Once) is a philosophy that prioritizes living in the moment and enjoying life to the fullest. YOLO advocates believe that life is short and unpredictable, and that experiences and memories should take precedence over long-term financial planning.

The YOLO mentality gained popularity in the early 2010s, particularly among millennials, as a reaction to the perceived limitations and constraints of traditional financial advice. YOLO encourages individuals to seize opportunities, take risks, and prioritize personal fulfillment over financial security.

Key Principles of YOLO

- Carpe Diem: YOLO emphasizes the importance of living in the present and making the most of every moment, rather than deferring happiness for the future.

- Experiential Living: YOLO prioritizes experiences over material possessions, encouraging individuals to invest in travel, hobbies, and personal growth.

- Flexibility: YOLO embraces a more fluid approach to life and career, with a willingness to take risks and pursue unconventional paths.

- Work-Life Balance: YOLO advocates for finding a balance between work and leisure, ensuring that one’s job does not consume their entire life.

Pros of YOLO

- Immediate Gratification: YOLO allows for the enjoyment of life’s pleasures in the present, rather than delaying gratification for an uncertain future.

- Increased Adaptability: The YOLO mindset fosters adaptability and resilience, as individuals are more open to change and new experiences.

- Personal Growth: By prioritizing experiences and taking risks, YOLO can lead to personal growth, self-discovery, and a more fulfilling life.

Cons of YOLO

- Short-Term Focus: YOLO’s emphasis on living in the moment can lead to a neglect of long-term financial planning and security.

- Financial Instability: Without a solid financial foundation, the YOLO lifestyle can result in financial instability and vulnerability to unexpected expenses.

- Potential for Regret: Making impulsive decisions based on the YOLO mentality can lead to regret and missed opportunities in the long run.

FIRE vs YOLO: A Comparative Analysis

To better understand the differences between FIRE and YOLO, let’s compare their approaches to key financial aspects:

| Aspect | FIRE | YOLO |

|---|---|---|

| Savings Rate | High (50%+) | Low to Moderate |

| Investment Strategy | Conservative, Index Funds, Real Estate | Varied, Often Higher Risk |

| Spending Habits | Frugal, Minimalist | Impulsive, Experience-Driven |

| Retirement Timeline | Early (30s-40s) | Traditional (60s+) |

| Work-Life Balance | Focused on Financial Goals | Prioritizes Leisure and Experiences |

As the table illustrates, FIRE and YOLO have vastly different approaches to savings, investing, spending, retirement, and work-life balance. While FIRE prioritizes long-term financial stability, YOLO emphasizes living life to the fullest in the present.

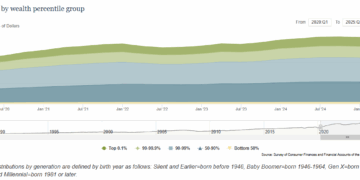

To further visualize the impact of these different approaches, consider the following hypothetical scenario:

Image if both the FIRE practitioner and the YOLO adherent both earns $60,000 annually.

In this example, the FIRE practitioner saves 50% of their income, while the YOLO adherent saves only 10%. Over a 20-year period, assuming an annual return of 7%, the FIRE practitioner’s savings grow to $1,229,864.77, while the YOLO adherent’s savings reach just $245,972.95. This stark difference highlights the long-term financial impact of the FIRE approach.

Here’s the breakdown for the FIRE practitioner:

- Annual savings: $60,000 * 50% = $30,000

- Using the future value formula: FV = PMT * (((1 + r)^n – 1) / r)

- FV = future value

- PMT = annual savings ($30,000)

- r = annual interest rate (7%)

- n = number of years (20)

Plugging in the numbers: FV = $30,000 * (((1 + 0.07)^20 – 1) / 0.07) = $1,229,864.77

Here’s the breakdown for the YOLO adherent:

- Annual savings: $60,000 * 10% = $6,000

- Using the future value formula: FV = PMT * (((1 + r)^n – 1) / r)

- FV = future value

- PMT = annual savings ($6,000)

- r = annual interest rate (7%)

- n = number of years (20)

Plugging in the numbers: FV = $6,000 * (((1 + 0.07)^20 – 1) / 0.07) = $245,972.95 (rounded to two decimal places)

However, it’s crucial to recognize that financial success is not the only measure of a fulfilling life. As Carl Richards, a certified financial planner and author, states:

“Personal finance is more personal than it is finance. It’s about your values, your goals, and your dreams. It’s about living the life you want to live.”

Finding Your Balance: A Hybrid Approach

While FIRE and YOLO represent two extremes on the financial spectrum, it’s possible to find a balance between the two. A hybrid approach that combines elements of both philosophies can offer a more sustainable and fulfilling path to financial well-being.

Consider the following strategies for striking a balance between FIRE and YOLO:

- Set Clear Financial Goals: Determine your short-term and long-term financial objectives, and create a plan to achieve them while still allowing for flexibility and enjoyment in the present.

- Prioritize Experiences Within Your Means: Allocate a portion of your income to meaningful experiences and personal growth, but do so within the constraints of your budget.

- Automate Your Savings: Establish automatic contributions to your savings and investment accounts to ensure consistent progress towards your financial goals, even as you enjoy life’s moments.

- Embrace Mindful Spending: Be intentional about your spending habits, focusing on purchases that align with your values and bring genuine happiness, rather than impulsive or status-driven consumption.

- Regularly Reassess Your Priorities: As life circumstances change, periodically review your financial plan and adjust your approach to ensure it continues to align with your evolving goals and values.

Bottom Line

The FIRE vs YOLO debate ultimately boils down to a question of personal values and priorities. While FIRE offers a path to financial freedom and early retirement, YOLO emphasizes living life to the fullest in the present. Both approaches have their merits and drawbacks, and the “right” choice depends on your individual circumstances and aspirations.

As you navigate your financial journey, remember that personal finance is just that – personal. By taking the time to understand your unique goals, values, and risk tolerance, you can develop a financial strategy that balances long-term security with the enjoyment of life’s precious moments.

Regardless of whether you lean towards FIRE, YOLO, or a hybrid approach, the key is to be intentional about your financial decisions and to align your money management with your definition of a fulfilling life. By doing so, you can create a financial roadmap that empowers you to live life on your own terms, both now and in the future.

Note: This blog post is written by a professional trader and investor based on personal experiences and opinions. It is not intended as financial advice. Always conduct your own research and consult a financial advisor before making any financial decisions.

Note: This blog post contains affiliate links. If you choose to make a purchase through these links, I may receive a small commission at no extra cost to you. This helps support the blog and allows me to continue creating content like this. Thank you for your support!