There’s a fundamental shift happening in how younger investors think about wealth building. The traditional path of climbing the corporate ladder until sixty-five no longer holds the same appeal it once did. As a Xennial who came of age during the dot-com bubble and witnessed the 2008 financial crisis firsthand, I’ve watched Gen Z investors embrace what I call “The New American Hustle”—prioritizing dividend income over day job income as the primary path to financial freedom.

I’m aligned with this thinking. Gen Z investors are increasingly loading up on dividend-paying stocks with a clear goal in mind: retire early and live off passive income streams. Having watched my own generation and the Boomers before us work themselves into exhaustion only to face uncertain retirement prospects, I’ve adopted a different approach alongside these younger investors. We’re building income-generating portfolios today so we don’t have to work until our bodies give out tomorrow.

This strategy resonates with me because it addresses a simple truth: freedom comes from owning assets that pay you, not from trading your time for money indefinitely. The goal isn’t necessarily to stop working entirely, but rather to reach a point where work becomes optional because your investments generate enough income to cover your living expenses.

My Overall Investment Framework

Before diving into the specifics of my Income Portfolio, I should clarify that income generation represents one component of my broader investment strategy. I maintain three distinct portfolio segments, each designed to serve different financial objectives and time horizons.

My Growth Portfolio focuses on capital appreciation through investments in companies and sectors positioned for long-term expansion. This portion of my portfolio accepts higher volatility in exchange for the potential of substantial returns over time. I also allocate capital to startup investments through FundRise, recognizing that early-stage ventures offer asymmetric return potential alongside significant risk.

My Preservation of Cash portfolio prioritizes capital protection and liquidity. This segment holds assets designed to maintain purchasing power and provide accessible funds for emergencies or opportunities. It serves as the foundation that allows me to take calculated risks elsewhere in my portfolio.

The Income Portfolio, which I’ll explore in detail throughout this article, focuses exclusively on generating reliable cash flow through dividend-paying securities and interest-bearing instruments. This diversified approach ensures that I’m simultaneously building wealth through appreciation, protecting capital through conservative holdings, and generating income through distributions. Each portfolio serves its purpose within my overall financial architecture.

My Income Portfolio Strategy

I’ve structured what I call my Income Portfolio specifically around generating reliable cash flow. Unlike growth investors who focus solely on capital appreciation, this particular segment of my holdings centers on building a diversified collection of income-generating assets. This portfolio consists of four main components: bonds (excluding zero-coupon bonds), Real Estate Investment Trusts, preferred stocks, and utility stocks.

Each component serves a distinct purpose in my overall income strategy. I deliberately avoid zero-coupon bonds because they don’t provide the regular income distributions I’m seeking from this portfolio segment. Instead, every asset in my Income Portfolio contributes to my quarterly and monthly cash flow, creating multiple income streams that compound over time.

Bonds: The Foundation of Stability

Bonds form the defensive anchor of my Income Portfolio. I focus on investment-grade corporate bonds and Treasury securities that provide regular interest payments. The bond allocation serves two purposes: it generates predictable income through coupon payments, and it provides stability during equity market volatility.

I specifically exclude zero-coupon bonds from this strategy because they don’t pay periodic interest. While zero-coupon bonds can be useful for specific financial goals like funding a future expense, they don’t align with my objective of generating current income. Instead, I prefer bonds that pay semi-annual coupons, ensuring a steady flow of interest payments that I can either reinvest or use for living expenses.

The current interest rate environment has made bonds more attractive than they’ve been in over a decade. Investment-grade corporate bonds are offering yields that actually compete with dividend stocks, providing a compelling risk-adjusted return for the stability they bring to the portfolio.

Real Estate Investment Trusts: Property Income Without Property Management

REITs represent one of my favorite components of the Income Portfolio because they provide exposure to real estate income without the headaches of property management. By law, REITs must distribute at least ninety percent of their taxable income to shareholders as dividends, which makes them exceptionally reliable income generators.

I diversify across different REIT sectors including residential, commercial, healthcare facilities, and data centers. This diversification is important because different property types perform well under different economic conditions. Healthcare REITs, for example, tend to be more resilient during economic downturns because demand for medical facilities remains relatively stable.

The beauty of REITs is that they allow me to benefit from real estate cash flows while maintaining liquidity. Unlike owning physical property, I can adjust my REIT positions as needed, and I don’t have to deal with maintenance calls, tenant issues, or property taxes directly. This complements my startup real estate investments through FundRise, which take a different approach to real estate exposure with longer lockup periods and different risk-return characteristics.

Preferred Stocks: The Hybrid Advantage

Preferred stocks occupy an interesting middle ground between bonds and common stocks. They offer higher yields than most bonds while providing more stability than common stock dividends. Preferred shares typically pay fixed dividends quarterly, and they have priority over common stockholders if the company faces financial difficulties.

I’m particularly drawn to preferred stocks from established financial institutions and utilities. These companies have long track records of maintaining their preferred dividend payments even during challenging economic periods. The yields on quality preferred stocks often exceed those available from the same company’s bonds, providing enhanced income potential.

One consideration with preferred stocks is their sensitivity to interest rate changes. Like bonds, preferred stock prices tend to fall when interest rates rise. However, since I’m focused on collecting the dividend income rather than trading the securities, short-term price fluctuations are less concerning. The consistent dividend payments are what matter for my long-term income strategy.

Utility Stocks: Reliable Dividends from Essential Services

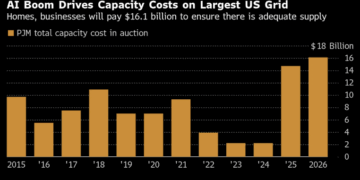

Utility stocks form the equity foundation of my Income Portfolio. These companies provide essential services like electricity, natural gas, and water that customers need regardless of economic conditions. This defensive characteristic makes utilities attractive for income investors seeking reliability.

Regulated utilities operate under a business model that’s particularly favorable for dividend investors. They’re granted monopolies in their service territories, which provides predictable revenue streams. In exchange for these monopolies, they face rate regulation that typically allows them to earn reasonable returns on their infrastructure investments. This arrangement creates a stable environment for consistent dividend payments.

Many utility stocks have raised their dividends consecutively for decades, earning them the designation of “Dividend Aristocrats.” This track record of dividend growth is important because it helps my income stream keep pace with inflation over time. A dividend that grows at three to five percent annually provides inflation protection while generating increasing cash flow.

The Mathematics of Dividend Independence

The fundamental equation driving this income strategy is straightforward: if your investment portfolio generates enough annual dividend income to cover your living expenses, you’ve achieved financial independence. The challenge lies in building a portfolio large enough to reach that threshold.

Consider a practical example. If your annual living expenses total fifty thousand dollars and you build a portfolio with an average yield of four percent, you would need one million two hundred fifty thousand dollars invested to generate that income level. While that’s a substantial sum, it’s achievable through consistent investing over time, especially when you reinvest dividends during the accumulation phase.

The power of this approach becomes clear when you compare it to traditional retirement withdrawal strategies. The conventional four percent rule suggests withdrawing four percent of your portfolio annually in retirement, which gradually depletes your principal. With a dividend-focused strategy generating a four percent yield, you’re living off the income your investments produce rather than selling assets. Your principal remains intact and potentially continues growing, while your income stream can increase through dividend raises.

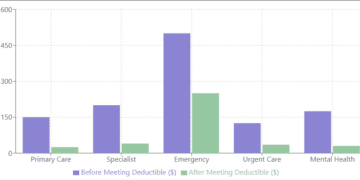

This table illustrates how different yield levels affect the portfolio size needed to generate specific income amounts:

| Annual Income Needed | 3% Portfolio Yield | 4% Portfolio Yield | 5% Portfolio Yield |

|---|---|---|---|

| $30,000 | $1,000,000 | $750,000 | $600,000 |

| $50,000 | $1,666,667 | $1,250,000 | $1,000,000 |

| $75,000 | $2,500,000 | $1,875,000 | $1,500,000 |

| $100,000 | $3,333,333 | $2,500,000 | $2,000,000 |

The table demonstrates why yield matters significantly in an income-focused strategy. A portfolio yielding five percent requires forty percent less capital than a three percent yielding portfolio to generate the same income level. However, higher yields often come with increased risk, which is why diversification across multiple income asset classes is so important.

Balancing Risk and Reward

I want to be clear that dividend investing is not without risks. Companies can cut or eliminate dividends during financial distress. Interest rates affect bond and preferred stock prices. REITs can struggle during real estate downturns. No investment strategy is bulletproof, which is why diversification across multiple asset types and individual securities is essential.

I also recognize that a pure income focus might sacrifice some total return potential compared to a growth-oriented strategy. Growth stocks that reinvest earnings rather than paying dividends have historically delivered strong long-term returns. This is precisely why I maintain separate Growth and Preservation of Cash portfolios alongside my Income Portfolio. Each segment addresses different aspects of wealth building and preservation. My approach accepts potentially lower total returns within the Income Portfolio in exchange for higher current income and reduced volatility. This tradeoff aligns with my personal goals for this specific portfolio segment.

Tax considerations also play a role in this strategy. Qualified dividends receive preferential tax treatment compared to ordinary income, but REIT dividends and bond interest are typically taxed at ordinary income rates. I account for these tax implications when evaluating the after-tax income my portfolio generates. For those building income portfolios, utilizing tax-advantaged accounts like IRAs for the least tax-efficient holdings can help optimize after-tax returns.

The Securities and Exchange Commission provides valuable resources for understanding bond investments, while their guidance on REITs can help investors evaluate real estate investment trusts. These resources have been instrumental in my own education as I’ve built out my Income Portfolio.

The Path Forward

Building an Income Portfolio requires patience, discipline, and a long-term perspective. I didn’t accumulate my positions overnight, and I continue adding to them systematically. The strategy works best when you reinvest dividends during your accumulation years, allowing compound growth to accelerate your progress toward financial independence.

What impresses me about Gen Z investors adopting this approach is their willingness to think differently about wealth building from the start of their careers. Beginning dividend reinvestment in your twenties or thirties gives your portfolio decades to compound before you need the income. Starting early also allows you to weather market downturns without needing to sell positions, since you’re not yet dependent on the income stream.

I view my Income Portfolio as a long-term project that evolves over time. As I learn more about different sectors and opportunities, I refine my holdings and adjust my allocations. The core principle remains constant: build a diversified collection of quality assets that generate reliable, growing income streams. This portfolio segment works in concert with my other investment strategies to create a comprehensive approach to wealth building.

The New American Hustle isn’t about getting rich quickly or taking excessive risks. It’s about methodically building income-generating assets that provide financial security and freedom. While others chase the latest speculative investments or remain trapped in the traditional work-until-retirement model, younger investors and those of us who’ve learned from past financial crises are focused on creating portfolios that work for us rather than the other way around.

This approach won’t appeal to everyone, and that’s appropriate for different financial situations and goals. But for those of us who value financial independence and the freedom to choose how we spend our time, dividend investing offers a proven path forward. The journey takes time and discipline, but the destination—a life where your investments provide for your needs—makes the effort worthwhile.