I am not a financial advisor. Let me make that crystal clear from the jump. I am no expert in finance, but I consider myself a student of the game—money management, investing, trading, all of it. A nerd if you will. I studied Finance and Investing at Baruch College, and right now I am working through the Series 65 prep from Kaplan. But my real education? That came from losing money and blowing up accounts. That is where the lessons hit different.

The School of Hard Knocks

Look, I ain’t gonna sit here and front like I got it all figured out from day one. Nah, man. I lost money—real money—trying to figure this thing out. Blew up accounts thinking I was smarter than the market. You know how it go: you hit on a couple trades, you start feeling yourself, thinking you got some kinda superpower or something. Then the market humble you real quick. And I mean real quick. That’s when you learn who you really are as a trader and what you can actually stomach when things go left.

If I learned anything over the years, it is understanding my risk tolerance and how to manage that. So in essence, I am a non-professional risk manager through trial and error. I have tried countless strategies to try and gain an edge, and I was willing to do so knowing that I could lose it all. Not a lot of people are willing to do that. It takes a special person to look at their hard-earned money and say, “I might lose this, but I am going to learn something either way.”

What Really Gets Under My Skin

What I really dislike—and I mean this gets me heated—is people selling non-suspecting individuals illusions of grandeur. I see these fake financial influencers on social media with their rented Lamborghinis and leased penthouses, talking about how they made six figures in a week with some secret strategy they will sell you for $997. Man, I just pray people don’t fall for it. The SEC has been warning people about these scams for years, but they keep multiplying like roaches.

This is not a get rich quick scheme. Period. It takes time, patience, and effort to find what edge works for you. Even with that, market dynamics change constantly. The edge that works for you today may not work for you tomorrow. The 2020 market taught us that. The 2022 market taught us something completely different. So you are constantly trying to gain more knowledge on new and improved strategies, adapting to whatever the market is throwing at you.

The Frustration of Watching People Struggle Unnecessarily

Another thing that gets me tight is when my people do not take advantage of the skill I possess. Yo, for real though—you got a friend in me that has a little knowledge that I can share, but you choose not to take advantage and then wonder why you are remaining in the poverty level that you are on. I done sat down with mad people, showed them simple things they could do to start building, and they nod along like they feeling it. Then a week later, they back asking me about some crypto scheme their cousin told them about. Come on, man.

Advising people financially—whether you are a professional or not—is not easy. Once you get a client’s profile and tell them based on that profile this is what is suitable for you, they do not want to hear it. They want to get rich now, not later. The disillusion people have baffles me. You tell someone they should start with index funds and build slowly, and they look at you like you just told them to watch paint dry. But that slow, boring approach? That is what actually works for most people.

The Key to Everything: Know Thyself

In my opinion, the key to successfully managing your money is to be realistic about your risk tolerance. This is not some abstract concept—this is about knowing yourself deeply. Can you sleep at night if your portfolio drops twenty percent in a week? Can you watch your account balance swing wildly and not panic sell at the bottom? Most people think they can until they actually experience it.

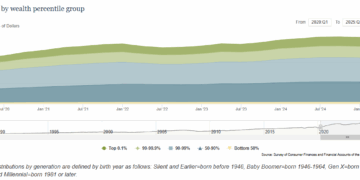

As the saying goes, “The bigger the risk, the greater the reward, but also the greater the loss.” Catch 22 much? This is the fundamental truth of investing that nobody wants to accept. Everyone wants the upside without the downside. Everyone wants to hit home runs without striking out. But that is not how this works. Understanding your risk tolerance means understanding what level of potential loss you can accept in pursuit of potential gain.

The Bottom Line

I share my story not because I have all the answers, but because I have made enough mistakes to help you avoid some of them. My financial foundation was built on losses, blown accounts, and humbling experiences. But through all of that, I learned to manage risk, to stay patient, and to keep learning even when the market changes the rules.

If you take nothing else from this, take this: be honest with yourself about what you can handle. Do not let social media fool you into thinking wealth comes overnight. Do not ignore the people in your life who genuinely want to help you level up financially. And whatever you do, understand that building real wealth is a marathon, not a sprint. The market will be here tomorrow, next year, and twenty years from now. The question is: will you be ready?

Stay disciplined. Stay learning. And most importantly, stay realistic about your risk.