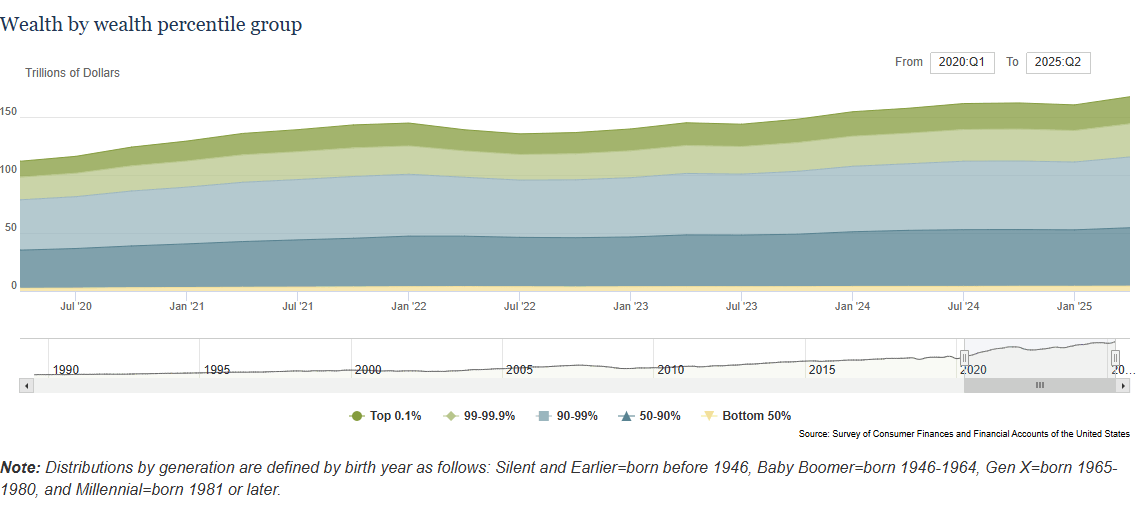

The pandemic changed everything. While many of us were worrying about job security and making ends meet, something remarkable happened in the financial markets. The investor class pulled away from the working class at a pace we haven’t seen in generations. The wealth gap didn’t just grow—it exploded. And if you weren’t paying attention, you missed one of the most significant wealth transfers in modern American history.

The technical reality of what happened since 2020 is straightforward but sobering. According to Federal Reserve data, the wealthiest Americans saw their net worth surge dramatically during the pandemic years. Stock markets recovered and then soared to record highs. Real estate values climbed. Those who owned assets benefited enormously, while those who relied solely on wages struggled with inflation and stagnant pay increases. The S&P 500 has delivered returns that far outpaced wage growth during this period, creating a widening chasm between those who participated in the markets and those who did not.

Here is the fundamental truth that nobody wants to acknowledge: in order to become part of the investor class, you must start in the working class. This is not a contradiction—it is the pathway. You cannot invest what you do not earn. The working class generates the income that becomes the seed capital for investment. The mistake is remaining exclusively in the working class and never making the transition to simultaneously being an investor.

For those of us who are risk management nerds—and I count myself proudly among that group—there is an abundance of educational resources available. The internet and social media have democratized financial education in ways that were unimaginable a generation ago. Platforms like Investopedia offer comprehensive tutorials on everything from basic investing principles to complex portfolio strategies. YouTube channels, podcasts, and financial communities on Reddit provide free education that rivals expensive courses. The barrier to financial literacy has been lowered dramatically. You can learn about index funds, dividend investing, retirement accounts, and risk diversification without spending a dollar on education.

Alternatively, if self-directed education is not your preferred path, you can engage a broker or financial advisor to manage investments on your behalf. Modern platforms like Vanguard, Fidelity, and Charles Schwab offer various levels of service, from completely self-directed accounts to fully managed portfolios. Robo-advisors have made professionally managed portfolios accessible at lower fee structures than traditional wealth management. The point is that the tools and resources exist for every knowledge level and comfort zone.

But let me break it down real simple. You cannot beat inflation by staying in the working class alone. That’s just facts. Inflation has been eating away at purchasing power, and wages have not kept pace. If you earned fifty thousand dollars in 2020 and you still earn fifty thousand dollars today, you can buy significantly less with that money. Your real purchasing power has declined. Meanwhile, those who invested in stocks, real estate, or other appreciating assets have seen their wealth grow substantially. The 2020s have been exceptional years for investors. Those who were heavily in debt or spent every paycheck without building any investment position have missed out on historic wealth creation.

I ain’t gonna front—when I first started putting money into the market, I was scared, man. I’m talking about that pit-in-your-stomach type of scared, ’cause where I’m from, you don’t play with your rent money, you feel me? But I educated myself, started small, and stayed consistent. And yo, watching that first dividend check come through? That was different. That was my money making money, and nobody had to wake up early for it.

The harsh reality is that the divide between the investor class and the working class will continue to widen unless working-class individuals make the conscious decision to also become investors. This does not mean abandoning employment—it means building a dual identity. You work to generate income, and you invest a portion of that income to generate wealth. The distinction between income and wealth is critical. Income pays your bills today. Wealth provides security and options for tomorrow.

It is never too late to begin. Whether you are twenty-five or fifty-five, the principles remain the same. Live below your means. Eliminate high-interest debt. Build an emergency fund. Then begin directing capital toward appreciating assets. The compounding effect of investment returns over time is the most powerful wealth-building tool available to ordinary individuals. The mathematics of compound interest do not discriminate based on your starting point—they reward consistency and time in the market.

The investor class is crushing it in the 2020s. They are capitalizing on market volatility, low interest rates, and unprecedented government stimulus that flowed disproportionately into asset prices. Those who sat on the sidelines, whether by choice or circumstance, watched this wealth creation happen without participating in it. The question now is whether the next decade will tell the same story, or whether more working-class individuals will make the transition to investor-class thinking and behavior.

The pathway is clear. The resources are available. The only remaining variable is the decision to begin. The working class and the investor class do not have to be mutually exclusive categories. You can be both. In fact, you must be both if you want to build real wealth in America today.

Stop waiting for the perfect moment. Stop thinking you need thousands of dollars to start. Stop believing that investing is only for wealthy people. Those beliefs are keeping you exactly where you are while the wealth gap grows wider every quarter. Educate yourself. Open an account. Start small if you need to. But start.

The investor class is not a closed club. The door is open. The question is whether you will walk through it.