Two years ago, I wrote about why time trumps money every single day of the week. Looking back at that piece now, I realize I was just scratching the surface. See, life has a funny way of teaching you lessons when you least expect them, and these past couple years? Man, they’ve been some real teachers.

But it wasn’t until I heard Tony Stark drop that line in the Marvel Cinematic Universe – “No amount of money can buy time” – that everything clicked into place. That quote hit me like a freight train rolling through 125th Street, because it perfectly captures what I’ve been trying to say all along, just with that Stark-level precision.

Why I’m Coming Back to This Topic

Let me keep it one hundred with y’all for a minute. Growing up in Harlem, time was something we never had enough of. My pops had many hustles, moms always did her best to keep food on the table, and everybody was chasing that next dollar like it was gonna solve all our problems. But you know what I noticed? The people with the most money in my neighborhood weren’t necessarily the happiest ones. They had the fly cars, the fresh kicks, the whole nine – but they were stressed, tired, and missing out on what really mattered.

Fast forward to today, and I’m seeing the same patterns everywhere. Folks making six figures but can’t remember the last time they had dinner with their family. People buying expensive vacations but spending the whole time checking emails. It’s like we’re trading our most valuable asset – time – for something that can’t even come close to replacing what we’ve lost.

The Tony Stark Principle: A Technical Breakdown

When Tony Stark said “No amount of money can buy time,” he wasn’t just being dramatic. He was stating a fundamental economic principle that most people completely miss. Let me break this down with the clarity it deserves.

Time operates on a finite supply model. Unlike money, which can theoretically be infinite through various economic mechanisms, time has a hard cap. Every human being gets approximately 700,000 hours in their lifetime. That’s it. No overtime, no extensions, no do-overs.

Money operates on an expandable supply model. You can earn more, invest it, multiply it, lose it, and earn it back. The supply is elastic and responsive to effort, strategy, and opportunity.

This creates what economists call a “non-substitutable asset relationship.” You cannot convert money back into time at any exchange rate. A billionaire dying of cancer cannot purchase additional years of life. A wealthy executive cannot buy back the childhood moments they missed with their kids.

“The bad news is time flies. The good news is you’re the pilot.” – Michael Althsuler

This quote from my original article still holds true, but now I understand it on a deeper level. Being the pilot means recognizing that every financial decision is fundamentally a time decision in disguise.

What Two Years of Living This Principle Has Taught Me

Since writing my original piece, I’ve conducted what I call “real-world beta testing” of the time-over-money principle. The results have been eye-opening.

The Compound Effect is Real: Every hour I invested in meaningful activities – learning new skills, building relationships, focusing on health – has paid dividends that money simply cannot match. Compare this to hours spent purely chasing financial gains without considering the time cost. The quality of life difference is stark.

The Opportunity Cost Framework: I developed a simple framework for making decisions:

| Decision Factor | Time Impact | Money Impact | Long-term Value |

|---|---|---|---|

| Taking a higher-paying job with longer hours | High negative | High positive | Usually negative |

| Investing in health and fitness | Moderate investment | Low cost | Extremely positive |

| Quality time with family/friends | High investment | Low/no cost | Immeasurably positive |

| Learning new skills | Moderate investment | Variable | High positive |

| Mindless entertainment consumption | High negative | Low cost | Negative |

The Automation Revelation: The smartest money moves I’ve made in the past two years weren’t about earning more – they were about buying back time through automation, delegation, and strategic choices that created temporal freedom.

Practical Applications of the Tony Stark Principle

Strategy 1: The Time Audit Revolution

Before making any major financial decision, I now conduct what I call a “time audit.” Here’s the process:

- Calculate the true time cost: How many hours will I need to work to afford this?

- Evaluate the time return: Will this purchase give me more meaningful time or take it away?

- Consider the opportunity cost: What else could I do with those hours?

Strategy 2: The 10-Year Test

When faced with time-versus-money decisions, I ask myself: “Ten years from now, will I remember how much money I made this year, or will I remember how I spent my time?”

This simple question has revolutionized my decision-making process. It’s guided me to turn down lucrative projects that would have consumed my weekends, and instead invest in experiences and relationships that have enriched my life in ways money never could.

Strategy 3: The Reverse Budget

Instead of budgeting money first and fitting time around it, I now budget time first and align my financial decisions accordingly. I block out non-negotiable time for health, relationships, and personal growth, then build my financial strategy around protecting those time investments.

“The present moment is the only time over which we have dominion.” – Thích Nhất Hạnh

The Stark Reality: Why This Matters More Than Ever

Living in 2025, we’re facing unprecedented time challenges. Technology was supposed to give us more time, but instead, it’s created an always-on culture where the boundaries between work and life have completely dissolved. Social media algorithms are designed to capture our attention – our time – and convert it into profit for others.

The Tony Stark principle isn’t just philosophical anymore; it’s become a survival strategy for maintaining sanity and meaning in an increasingly chaotic world.

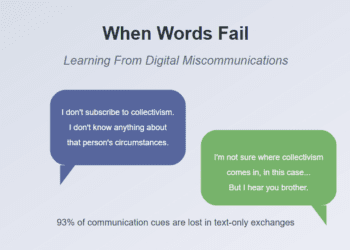

The Data Speaks: Recent studies show that Americans check their phones over 100 times per day, spending nearly 7 hours staring at screens. That’s nearly 2,500 hours per year – more than a full-time job – spent on activities that add minimal value to our lives.

Meanwhile, the average American spends less than 40 minutes per day in meaningful conversation with family members. We’re literally trading the most valuable moments of our lives for digital distractions.

Building Your Time-First Financial Strategy

Here’s the framework I’ve developed for making financial decisions through the lens of time value:

Phase 1: Establish Your Time Baseline

- Track how you spend time for one week

- Identify activities that genuinely add value to your life

- Calculate the hourly “cost” of your current lifestyle

Phase 2: Implement Time Protection Measures

- Set boundaries around work hours

- Invest in tools and services that buy back time

- Learn to say no to opportunities that don’t align with your time values

Phase 3: Optimize for Time ROI

- Choose career paths that offer temporal flexibility

- Make purchasing decisions based on time saved, not just money saved

- Build passive income streams that don’t require constant time input

The Compound Effect of Time Choices

What I’ve learned over these past two years is that time choices compound exponentially. Every hour you invest in your health today pays dividends for decades. Every moment of quality time with loved ones builds relationship capital that enriches your entire life. Every minute spent learning and growing expands your future possibilities.

Conversely, every hour wasted on meaningless activities is gone forever. Every moment spent stressed about money you don’t need robs you of peace you can’t buy back. Every day spent in a job you hate for money you don’t enjoy is a day you’ll never get to live again.

The Bottom Line: Your Time, Your Choice

Tony Stark had it right from the beginning. No amount of money can buy time, but the inverse is also true: time well-invested can create wealth that money alone never could – wealth of experience, relationship, health, and purpose.

The choice is yours, and it’s a choice you make every single day, every single hour, every single moment. You can continue operating under the old paradigm where money drives your time decisions, or you can embrace the Tony Stark principle and let time guide your financial choices.

As I look back on the past two years since my original article, I’m grateful for every moment I chose time over money, and I regret every instance where I did the opposite. The clock is still ticking, but now I’m flying this plane with a clearer understanding of what truly matters.

Your mission, should you choose to accept it: Start making decisions as if time is your most valuable asset, because it is. Protect it fiercely, invest it wisely, and never trade it for anything less than what truly enriches your life.

After all, in the end, we won’t be remembered for the money we accumulated, but for how we chose to spend the precious time we were given.

What time choices will you make differently starting today? Share your thoughts and commitment in the comments below.