Listen, I’m gonna keep it real with y’all from the jump.

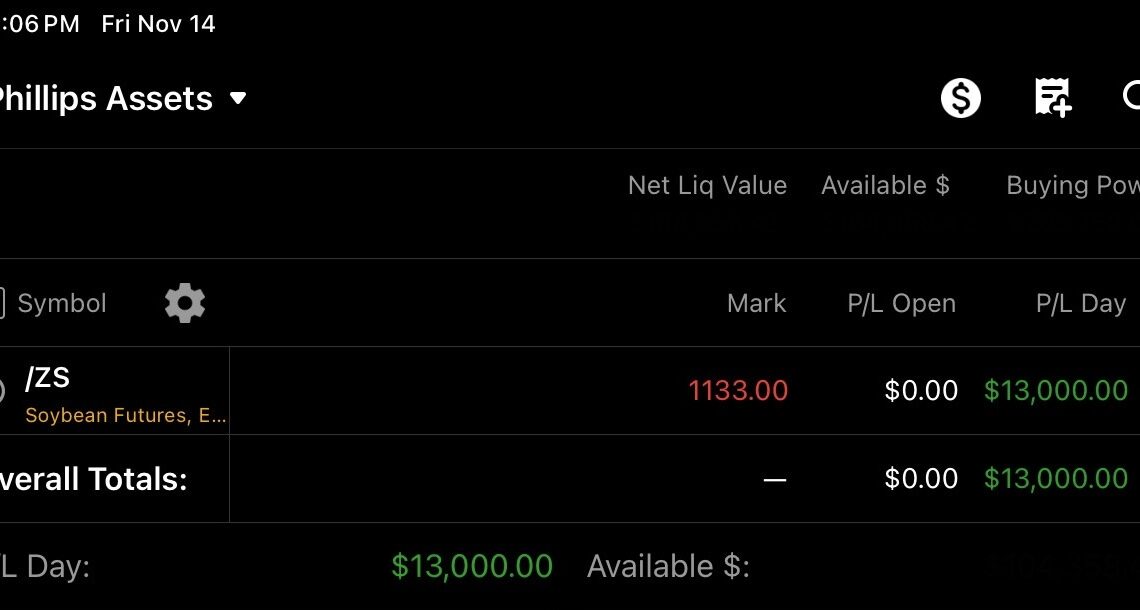

This past Friday at exactly 12:00pm, I shorted Soybean Futures—ticker symbol /ZSF26 for those keeping track. By 12:01:47pm, I’d already closed half the position. By 12:02:38pm, I was completely out. The result? $13,000 in profit before commission and fees. No algorithm. No high-frequency trading setup. Just me, the data, and a calculated move.

Naturally, I posted my P/L screenshot on my Instagram story. But before y’all start thinking I’m out here bragging every time I make a dollar, let me explain something. I got a rule I stick to: I only share profit and loss when it’s above, below, or equal to $10,000. That’s my threshold. For the record, I’ve never lost $10,000 or more on a single trade, and the last time I even took a loss was back in May. I’m not saying this to flex—I’m saying it because context matters.

The Setup Wasn’t Luck, It Was Preparation

Friday morning, the USDA released their WASDE report (that’s the World Agricultural Supply and Demand Estimates for those who don’t know). This report moves markets, straight up. When I saw it was dropping, I immediately pulled up Soybean Futures to analyze what might happen.

Here’s where it gets technical. I looked at the options statistics one minute before the report release. Based on what I was seeing—the implied volatility, the put-call ratio, the positioning—I calculated roughly a 63% probability that soybean futures prices would decline following the report’s data.

The market doesn’t care about your feelings. It only responds to supply, demand, and the data that drives both.

Luckily for me, my read was correct. The futures sold off, and I was positioned exactly where I needed to be.

The DMs Started Rolling In

So after I posted that story, my DMs lit up. I ain’t gonna lie, I expected it. People want to know: “Yo Van, can you teach me how to make $13,000 in three minutes?” “What’s your strategy?” “Can I pay you to show me your setup?”

I get it. I really do. When you see someone make in three minutes what might take you a week or two to earn at a regular job, it looks like magic. But let me tell you something important—something I need y’all to understand fully.

Why I’m Not Teaching This

First off, I’ve been investing for damn near 20 years now. I only started actively trading during COVID, but those two decades of studying markets, understanding financial instruments, and building my knowledge base? That’s the foundation everything else sits on. You can’t skip that part.

Second, trading is extremely risky. I’m talking potential-to-lose-everything risky. There is no one-size-fits-all strategy that works for everyone. What works for me might blow up your account. The risk tolerance I have, the capital I’m working with, the time I can dedicate to watching positions—all of that is specific to my situation.

But here’s the real talk that might upset some people: The reason traders don’t give away their edge—especially for free—is because if everyone starts using the same edge, it stops being an edge. Markets are competitive. They’re adversarial. Your profit is literally someone else’s loss. If I taught my exact methodology to thousands of people, we’d all be fighting over the same setups, and the opportunities would vanish.

Think about it. If there was a genuine get-rich-quick formula that anyone could follow, why would anyone work a regular job? The people selling you courses and promising easy money are making their real money from you, not from trading.

I’m Not Your Financial Advisor

I need to be crystal clear about this because it’s important both legally and ethically: I am not a financial advisor. I’ve said this before in my article Real Talk About Money: What They Don’t Tell You About Building Wealth, and I’ll say it again. If you haven’t read that piece yet, you should. It’s probably one of the realest things I’ve written about my actual journey with money—the good, the bad, and everything in between.

I share my trades occasionally to document my journey and to show what’s possible when you put in the work. But I’m not out here giving financial advice or telling anyone what to do with their money.

The Bottom Line

That three-minute trade on Friday? It was built on years of foundation. It was data analysis, probability assessment, risk management, and execution. It was also accepting that even with a 63% probability in my favor, there was still a 37% chance I could’ve been wrong.

If you’re serious about trading, start by educating yourself. Read everything you can about markets. Paper trade until you understand what you’re doing. Learn about risk management and position sizing. Understand that losses are part of the game. And most importantly, never risk money you can’t afford to lose.

I’m not trying to discourage anyone from pursuing trading if that’s genuinely what you want to do. I’m just being honest about what it takes and why you won’t find me selling courses or giving away my exact playbook.

Stay smart out there. Protect your capital. And remember—there are no shortcuts to mastery.

Van