When digital artist Beeple recently posted artwork poking fun at critics who claim his famous “Everydays” NFT has become worthless, it sparked something in me. Not schadenfreude exactly, but a moment of reflection on one of the most spectacular speculative bubbles I have witnessed in my lifetime. The piece served as a cultural artifact in itself—a meta-commentary on the very volatility that has defined the non-fungible token market since its meteoric rise and subsequent collapse.

I remember when NFTs exploded into mainstream consciousness in 2021. Suddenly, everyone from tech enthusiasts to celebrities to my own social circle was talking about these digital tokens as if they represented the future of art, ownership, and investment itself. The enthusiasm was infectious, the promises grandiose, and the price tags astronomical.

Yet from the very beginning, I found myself unable to shake a fundamental skepticism.

The Emperor’s New Digital Clothes

My doubts were not sophisticated or technical. They were almost embarrassingly simple. When I saw people spending thousands or even millions of dollars on digital images, my first instinct was to ask the most obvious question: What would stop anyone from simply right-clicking and saving a copy of that artwork to their computer?

It seemed almost too obvious to be a valid criticism, yet I could not get past it. The entire premise felt hollow, like watching people bid on certificates of authenticity for air. I voiced these concerns to friends, to colleagues, to anyone who would listen. Most dismissed my skepticism as a failure to understand the technology or envision the future.

The Technical Explanation That Still Did Not Add Up

One friend, who had invested heavily in the NFT market, took it upon himself to educate me. He explained with genuine enthusiasm how non-fungible tokens worked on the blockchain. Each NFT, he said, was a unique digital certificate stored on a distributed ledger—most commonly Ethereum’s blockchain. This certificate proved ownership of a specific digital asset, whether that was an image, a video, a piece of music, or even a tweet.

“The blockchain is immutable,” he explained. “No one can forge or duplicate your token. You own the original, and everyone can verify that ownership.”

He walked me through the technical architecture: smart contracts that automated transactions, decentralized networks that eliminated intermediaries, cryptographic hashing that ensured authenticity. He showed me marketplaces like OpenSea and Rarible where these tokens traded hands for eye-watering sums. He talked about utility, community access, and the revolution of digital scarcity in an age of infinite reproducibility.

I listened. I tried to understand. But even after his detailed explanation, I remained unconvinced.

The problem, as I saw it, was not with the technology itself. The blockchain could indeed verify that I owned a particular token. But what did that token represent? In most cases, it did not convey copyright. It did not prevent others from viewing, sharing, or displaying the associated digital image. It did not grant exclusive access to anything tangible. It was, essentially, a receipt—a very expensive receipt—for a digital file that anyone could access for free.

The value proposition required believing that others would continue to ascribe value to that receipt. It required faith in perpetual demand. And that faith, to me, seemed built on nothing more substantial than collective agreement and aggressive marketing.

So I made the decision that, in hindsight, saved me from significant financial loss: I did not buy any NFTs.

The Inevitable Collapse

The NFT market peaked in early 2022, with total sales volumes reaching approximately $2.8 billion in May of that year, according to data from various market trackers. Then came the decline—slow at first, then accelerating into what can only be described as a collapse.

The numbers tell a stark story:

| Period | Approximate Monthly NFT Sales Volume |

|---|---|

| January 2022 | $6.8 billion |

| May 2022 | $2.8 billion |

| September 2022 | $466 million |

| March 2023 | $1.6 billion (brief recovery) |

| September 2023 | $296 million |

By 2024, the market had contracted even further. A study suggested that approximately 95% of NFT collections had become effectively worthless, with no market liquidity and no buyers willing to pay even minimal amounts for tokens that had once commanded significant premiums.

The celebrities who had enthusiastically promoted NFT projects found themselves on the wrong side of history. The influencers who promised that JPEGs of cartoon apes would revolutionize wealth creation went quiet. The millions of dollars that had flowed into profile pictures and digital collectibles simply evaporated as the speculative fervor cooled and reality reasserted itself.

The $69 Million Masterpiece That Was Not

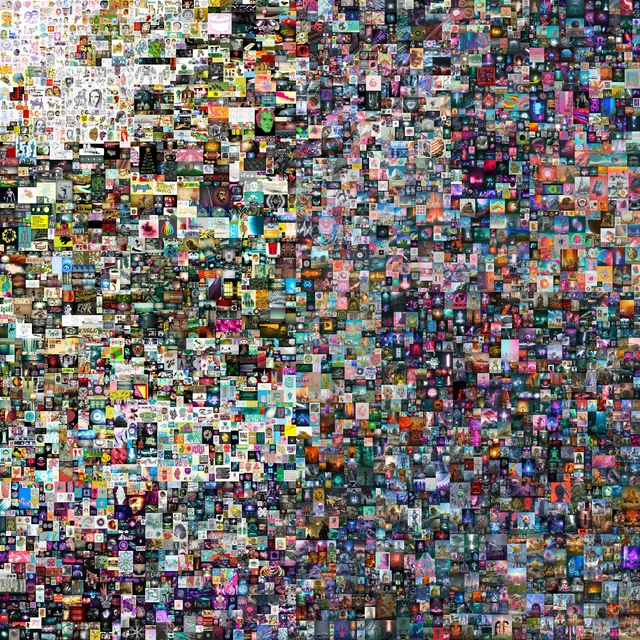

Perhaps no single transaction better encapsulates the NFT phenomenon than the sale of Beeple’s “Everydays: The First 5000 Days.” In March 2021, at the height of the mania, this digital collage—a compilation of 5,000 individual artworks created over thirteen years—sold at Christie’s auction house for $69.3 million. The buyer was Vignesh Sundaresan, known in crypto circles as MetaKovan.

At the time, the sale was hailed as a watershed moment. Major news outlets covered it extensively. Art world commentators debated whether it signaled the democratization of art or its commodification. The astronomical price tag seemed to validate the entire NFT ecosystem and suggested that digital art had achieved parity with traditional physical works.

Fast forward to today, and the picture looks considerably different. Various valuation estimates have placed the current worth of “Everydays” at a fraction of its purchase price—some suggesting it may now be valued as low as $100 to a few thousand dollars, though precise current valuations remain difficult to ascertain given the lack of market liquidity for such high-profile pieces.

Whether these low estimates are accurate or merely provocative speculation, the broader point remains undeniable: the asset has lost an enormous amount of its perceived value, and there is no obvious path to recovering anything close to the original $69.3 million investment.

The Anatomy of a Bubble

What happened with NFTs was not novel or unique in economic history. It followed a pattern that has repeated itself across centuries, from Dutch tulip mania in the 1600s to the dot-com bubble at the turn of the millennium. The specific technology changes, but the human psychology remains constant.

The cycle typically unfolds in predictable stages. First comes innovation—a genuinely new technology or concept that captures attention. Then comes speculation, as early adopters see an opportunity for profit. Media coverage amplifies the excitement, drawing in a broader audience. Prices rise not based on intrinsic value but on the expectation that someone else will pay even more in the future. This is the “greater fool theory” in action: you may be a fool for buying at an inflated price, but as long as a greater fool comes along to buy from you at an even higher price, you profit.

Eventually, the supply of greater fools runs out. The music stops. Those who got in early and exited quickly make their fortunes. Those who bought near the peak, convinced by the hype and the fear of missing out, become what traders call “bag holders”—stuck holding assets they cannot sell at any price that does not represent a devastating loss.

The NFT market illustrated this progression with textbook precision. The technology itself—blockchain-based digital certificates—was real and functional. But the valuations placed on these certificates bore no relationship to any fundamental utility or productive value. They were based purely on speculation and the hope that the trend would continue indefinitely.

It did not.

What Should Have Been Obvious

Looking back, the warning signs were everywhere. When celebrities with no particular expertise in technology or digital art began promoting NFT projects, it should have been a red flag. When the primary selling point became potential investment returns rather than the intrinsic value or utility of the digital assets themselves, it should have raised concerns. When more energy was spent on marketing and community building than on creating anything of lasting substance, skepticism should have prevailed.

The fundamental question I kept asking—”What stops someone from just downloading a copy?”—never received a satisfactory answer because there was not one. The technology could verify ownership of a token, but it could not create artificial scarcity for infinitely reproducible digital files. It could not force others to respect that ownership in any meaningful way. It could not, ultimately, sustain valuations disconnected from reality.

The Broader Lesson

The NFT phenomenon offers lessons that extend far beyond blockchain technology or digital art. It reminds us that not every innovation justifies the valuations placed upon it during periods of speculative excess. It demonstrates how social proof and fear of missing out can override rational analysis and basic skepticism. It shows how quickly collective delusions can form and how painfully they collapse when reality intervenes.

For those of us who resisted the temptation to join the rush, there is perhaps a quiet vindication. Not because we possess superior intelligence or foresight, but simply because we asked basic questions and found the answers unsatisfying. We trusted our instincts when something seemed too good to be true, and we were willing to risk missing out rather than risk losing what we had.

The investors who poured millions into NFTs, the celebrities who lent their names to dubious projects, the casual buyers who spent thousands on digital collectibles they hoped would appreciate—they were not stupid. They were caught up in a moment, influenced by social dynamics and persuasive narratives, and willing to take a gamble on what appeared to be a transformative new asset class.

But in the end, fundamentals matter. Sustainable value requires more than collective agreement and clever marketing. It requires utility, scarcity that is not merely artificial, and economic logic that extends beyond the hope that someone else will pay more tomorrow than you paid today.

Moving Forward

When Beeple posted his recent artwork commenting on his NFT’s perceived worthlessness, he was engaging with a narrative that has largely moved from speculation to reality. The piece itself is a form of commentary on value, perception, and the ephemeral nature of trends—themes that have always been central to contemporary art but which took on new meaning in the context of the NFT boom and bust.

For me, the entire episode reinforced a simple principle: skepticism, particularly when everyone around you is caught up in enthusiasm, is not pessimism. It is prudence. Asking basic questions is not a sign of failing to understand the future. It is a sign of trying to understand the present.

Trends and fads will always come and go. New technologies will create new opportunities for both innovation and speculation. The challenge is distinguishing between the two, resisting the pull of social proof when it contradicts rational analysis, and accepting that sometimes the best investment is the one you do not make.

I did not buy NFTs when they were selling for millions. I do not regret that decision now that many have become functionally worthless. The $69 million question has been answered, and the answer is exactly what basic skepticism suggested from the beginning: the value was never really there.